Duke Allen & Co. Loan Options.

FIX-AND-FLIP /

BRIDGE

Up to 100% LTC including purchase price + rehab

Up to 70% LTARV

9.99% - 15% interest with appraisal

2 - 4 points

$995 average underwriting fee

No experience required for funding

No minimum credit requirement to qualify for funding

RENTAL LOANS DSCR LONG-TERM PURCHASE /

CASH-OUT REFINANCE

Up to 75% LTV for refinances and 80% LTV for purchases

7.75%+ interest

2-4 points

15-30 year fixed rate

5/7/10 year adjustable rate

Amortized over 30 years

Appraisal or BPO required

Non-recourse Loan

Portfolio loans available

TRANSACTIONAL FUNDING

We offer transactional funding to purchase and sell a property during the same day. The A-B transaction we lend on must be contingent on funding of the B-C transaction. Both must be verified by the title company or closing attorney and must occur within 24 hours of each other.

There is an average fee of 1% of the loan amount, but this may vary based on the size of the loan.

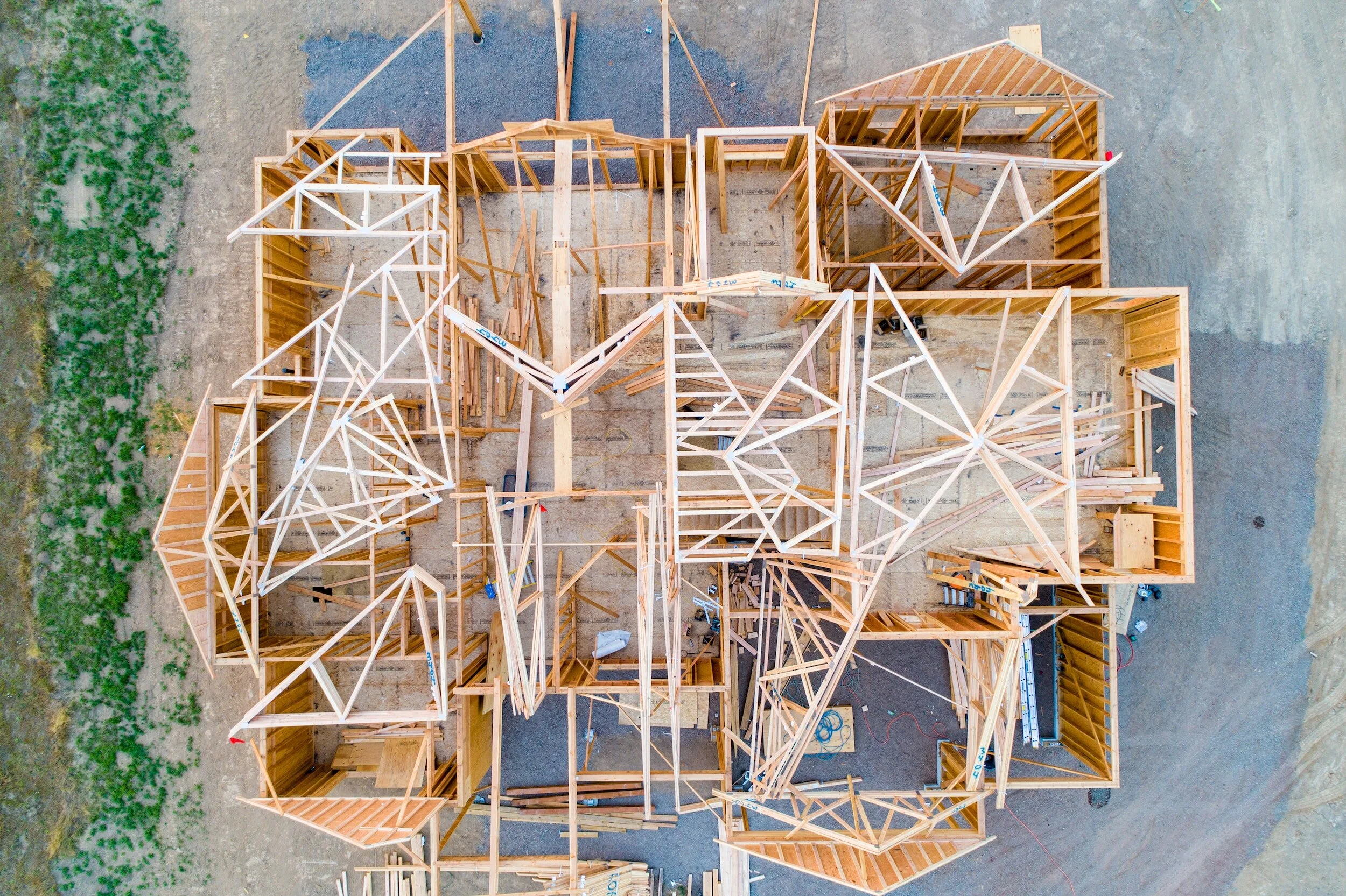

NEW CONSTRUCTION

Up to 18 Month Term

Loan Size minimum of $200,000

Loan to Value up to 65%

Loan to Cost up to 85%

9.99% - 15% interest with appraisal

2 - 4 points

$995 average underwriting fee

No experience required for funding

No minimum credit requirement to qualify for funding